Income Tax department asks Flipkart to reclassify discounts as Capex

MUMBAI: Flipkart has lost an appeal against the income-tax department over the reclassification of marketing expenditure and discounts as capital expenditure, which involves substantial tax liabilities. It could impact the way startups are taxed in the country, experts said.

The ruling was made in December but isn't publicly known. The issue involves money spent by ecommerce companies on marketing through deep discounts. Flipkart along with Amazon and some of the other big ecommerce companies have been classifying this as marketing expenses and deducting it from revenue, leading to them posting losses and therefore not being liable to tax.

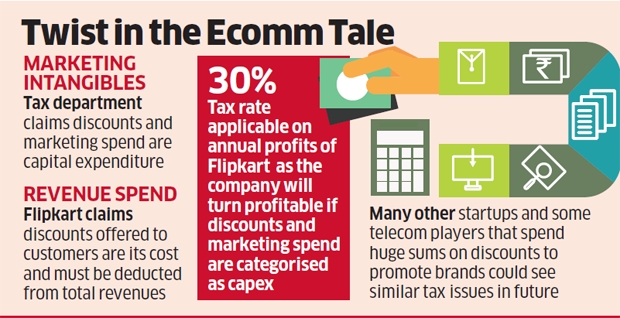

The tax department, however, contends that this is not a cost but a capital expenditure, which means it should not be deducted from revenue.

The Bengaluru I-T office had asked Amazon and Flipkart to reclassify marketing expenditure as capital expenditure. Both approached the Commissioner of Income Tax (Appeals), Bengaluru, in August last year. In December, the CIT (Appeals) hearing Flipkart's case ruled in favour of I-T department and said the company must reclassify its discounts and marketing expenses as capex. Capital expenditure, according to the I-T department, has to be spread over four to 10 years.

Liable to Pay 30% Tax

If that happens, companies such as Flipkart and Amazon that incur substantial marketing costs could be deemed as being profitable and therefore liable to pay 30% tax. Flipkart didn't respond to an email sent on Thursday. A senior executive at the company, however, confirmed the development and added it's looking to challenge the order at the Income Tax Appellate Tribunal (ITAT) in the next few days.

Experts said the revenue department's stand will hit startups and ecommerce companies and that it appears to dictate how entrepreneurs must conduct their businesses. "The tax department is obviously picking on the companies' oft-repeated claim that the discounts are aimed at accruing market share for future profitability, but it's highly unlikely that such reasoning will stand scrutiny in courts," said Abraham C Mathews, a Supreme Court advocate. "Supreme Court rulings have held that even if the benefit is of enduring nature, it can be classified as revenue expense."

The income tax department is taking the stand that discounts and large marketing costs are a part of the brand-building exercise. "These discounts along with huge marketing and advertising expenses are creating market intangibles for the company," said an official close to the development. "This means these are not costs but capital for the company."

The tax department is yet to specify the exact amount the companies may be liable for.

(This news is an extract from Economic Times, written by Sachin Dave. Full article can be read in Economic Timeshere.)

Media Roundup includes tax related news coverage in media, Nepal and abroad, that we find useful to share to our readers. We do not own the contents of these news articles, and Nepal Tax Online team is not included in the process of publication of these news. We also do not vouch for authencity when publishing. The source of the news article is published at the bottom of each news, where possible.